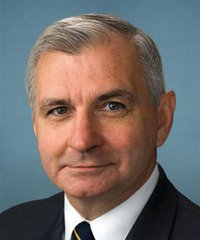

Jack Reed is a champion for middle-class families and a strong believer that all Americans should have the opportunity to build a better life.

Jack was born and raised in Cranston and grew up on Pontiac Avenue. His father, Joe, was a World War II veteran and Cranston school janitor who worked his way up to become custodial supervisor of the city's school system. His mother, Mary, was a homemaker who was unable to go to college herself, but made sure her three children studied hard and had the opportunity to pursue a higher education. The Reed family benefited from the GI Bill – a program that helped countless veterans further their education and put a roof over their heads – and Jack’s parents instilled in him the importance of serving his country and giving back to his community.

Restoring Fiscal Discipline and Promoting Responsible Budgets

As the United States emerges from a decade of two costly wars, unaffordable tax cuts in the early 2000s, and the worst economic crisis since the Great Depression, Senator Reed is working hard to put our nation back on a sound fiscal course.

Restoring fiscal discipline means making difficult decisions to align spending priorities with revenues, while also maintaining economic growth today and into the future. Senator Reed believes that the best path forward to achieve these goals is to follow the same type of plan developed in the 1990s, when the laws he supported created the first budget surplus in nearly 30 years.

Controlling America’s debt and restoring fiscal discipline is a shared sacrifice. Senator Reed supports a budget that fosters strong economic growth, and believes that a prospering, resilient middle class is the key to a greater future for all Americans. He understands that cutting programs like Medicare and preserving tax breaks for the wealthy is not a smart decision for long-term prosperity.

Senator Reed believes that a reformed tax code that helps balance the budget, strengthens the middle class, and provides smart incentives for job creation is the path forward. A responsible combination of spending reductions, reforming the tax code, and economic growth through a growing middle class will accomplish exactly that.