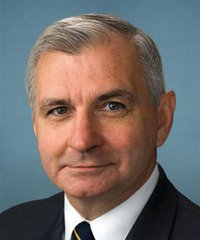

Jack Reed is a champion for middle-class families and a strong believer that all Americans should have the opportunity to build a better life.

Jack was born and raised in Cranston and grew up on Pontiac Avenue. His father, Joe, was a World War II veteran and Cranston school janitor who worked his way up to become custodial supervisor of the city's school system. His mother, Mary, was a homemaker who was unable to go to college herself, but made sure her three children studied hard and had the opportunity to pursue a higher education. The Reed family benefited from the GI Bill – a program that helped countless veterans further their education and put a roof over their heads – and Jack’s parents instilled in him the importance of serving his country and giving back to his community.

Senator Reed fights hard to put consumers first. He has worked to increase investor protections, improve the transparency of complex financial markets and products, and toughen federal oversight of investment banks and securities firms.

When the economy collapsed in 2008, Reed wrote the law ensuring taxpayers would share in the rewards when the banks recovered. As a result of Reed’s efforts, taxpayers have earned more than $9.4 billion in additional dividends – money that would have otherwise been kept by the rescued banks.

Reed has focused particular attention on ensuring the Securities and Exchange Commission’s (SEC) authority to aggressively pursue fraud, improve its risk management capabilities, and protect investors by enhancing the agency’s technological resources to police Wall Street. He has authored laws to strengthen the SEC’s ability to bring enforcement actions, address issues revealed by the Madoff fraud, and modernize the SEC’s ability to obtain critical information.

In order to bring transparency and accountability to Wall Street, Senator Reed helped write several key pieces of the historic Wall Street Reform and Consumer Protection Act, including a provision establishing a new Consumer Financial Protection Bureau (CFPB). He also created the independent Office of Financial Research, which researches and analyzes risk throughout the financial system. This should give financial regulators the data and analytical power they need to understand the factors that threaten our financial system, provide early warnings, and allow regulators to act on this information to protect our economy.

Senator Reed also joined forces on a bipartisan basis to establish within the CFPB an Office of Servicemember Affairs. This new office acts as a consumer watchdog for servicemembers, veterans, and their families by helping to monitor financial scams and predatory lending that target them.